Comparing Online VAT Calculators: Which Tool is Right for You?

Value Added Tax (VAT) calculations are a key element of financial reporting and tax compliance for UK businesses and individuals. Online VAT calculators are invaluable tools that automate complex VAT math, saving huge time and effort. But with so many options available, how do you choose the right VAT calculator for your needs?

This comprehensive guide examines the key features and capabilities of popular online VAT calculators. We’ll compare our fully-featured advanced calculator against basic free government tools, limited mobile apps, and clumsy spreadsheet templates. Discover how our VAT calculator at https://onlinevatcal.co.uk/ outperforms in ease of use, customization, and functionality.

HMRC VAT Calculator

The HMRC VAT Calculator is a free online tool provided by the UK tax authority. It serves as an adequate basic calculator, but lacks several important capabilities:

- Only allows the current 20% VAT rate – no customization for past or future rates

- No ability to remove VAT from an amount

- Very sparse interface with limited inputs and outputs

- Results not savable or exportable

- Not optimized for mobile devices

- No reporting functionality

While a useable basic option for simple VAT math, the limitations reduce applicability for many businesses and individuals. It lacks the flexibility, features and mobility required for convenient VAT planning.

Mobile VAT Calculator Apps

Various mobile apps like VAT Calculator Plus provide VAT mobile calculation capability. However, they tend to offer limited functionality beyond the basic HMRC tool:

- Ability to save results is a plus

- But VAT rate customization is still not available

- Generally only provide calculator with no detailed guidance

- Small touch targets and cluttered interface on smaller screens

- Data security and privacy concerns with some vendors

Mobile VAT apps provide convenience over spreadsheet templates, but still leave much to be desired for smooth advanced VAT calculations.

Excel VAT Calculator Templates

Downloading VAT calculator templates for Excel allows local use and some customization, but has some distinct drawbacks:

- Requires Microsoft Excel purchased or installed

- Advanced functionality requires complex manual Excel skills

- Not seamless or mobile-accessible like web or app calculators

- Difficult to share and use collaboratively

- Significant effort to update templates as VAT rules and rates change

- Higher risk of formula errors causing incorrect calculations

Overall, Excel VAT templates provide flexibility at the cost of usability and convenience compared to online tools.

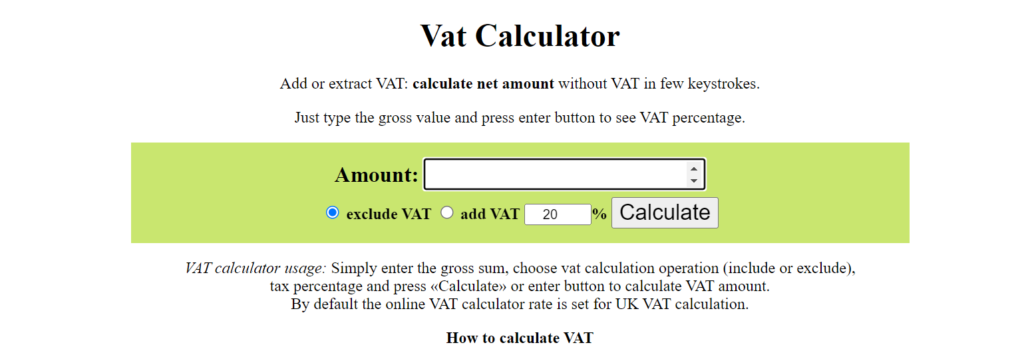

Other Online VAT Calculators

There are other online VAT calculators, but many have limitations:

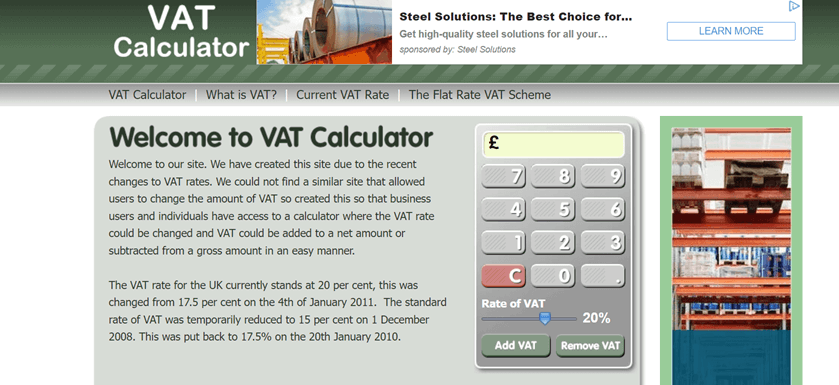

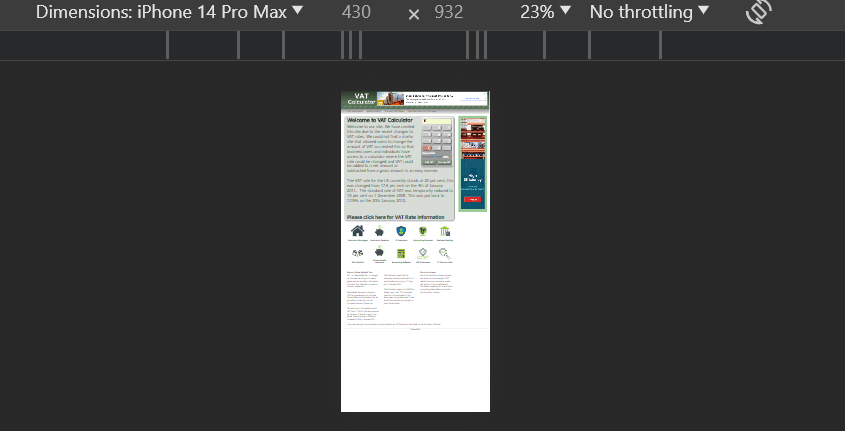

www.vatcalculator.co.uk – Has mobile responsiveness issues and only supports 10% to 25% VAT rates.

www.vatcalculators.co.uk – Wider 10% to 27% rate range but unattractive design.

vatcalconline.com – Clean but not mobile-friendly and basic functionality.

Our Advanced Online VAT Calculator

Our fully-featured advanced VAT calculator delivers the ultimate combination of accuracy, customization, and ease of use:

- Custom VAT Rates – specify any rate between 10% to 30% for complete flexibility.

- Mobile Optimized Interface – beautifully designed, responsive interface works perfectly on all mobile and desktop devices.

- Downloadable PDF Reports – save professional VAT calculation reports for enhanced record keeping and reporting.

- Full-Screen Mode – toggles to a immersive, full-screen calculator for maximum visibility.

- Advanced 10-Key Input – Specialized numeric keypad enables quick and accurate amount entry.

- VAT Adding & Removing – Supports seamlessly adding net to gross or removing VAT from gross amounts.

- Clean, Intuitive Design – Simple, uncluttered layout for easy VAT calculations at a glance.

For flawless VAT calculations anytime, anywhere and from any device, our online calculator is the ultimate tool with all the features you need.

Key Takeaways: Choosing your VAT Calculator

Here are the key considerations when selecting your VAT calculator:

- Flexibility – Customizable and past/future VAT rates support

- Functionality – Capabilities like mobile experience, reporting, advanced inputs etc.

- Convenience – Accessible online from any device

- Ease of Use – Intuitive, clean interface

- Accuracy – Precision calculations matching HMRC

- Cost – Budget requirements if paid tools

With the most flexible and advanced features optimized for usability, our online VAT calculator is the premier choice for individuals and businesses. Achieve expert level VAT calculations instantly and accurately using our indispensable tool.

FAQs About The VAT Calculator

Here are some sample FAQs about comparing and selecting online VAT calculators:

Q: What should I look for in an online VAT calculator?

A: Key features to look for include customizable VAT rates, mobile responsiveness, downloadable reports, intuitive interface, VAT adding/removing modes, and advanced inputs like numeric keypad.

Q: How do government VAT calculators like HMRC compare?

A: Government calculators provide basic features but lack customization, advanced inputs, mobility, reporting and full functionality compared to advanced third-party tools.

Q: What are the pros and cons of Excel VAT calculator templates?

A: Excel provides offline flexibility but requires manual skills, updating, and lacks the accessibility and seamlessness of online calculators. Risk of formula errors too.

Q: Should I use a mobile app or web-based calculator?

A: Web-based calculators offer full functionality and are accessible from any device with a browser. Mobile apps can be limited but provide offline use.

Q: How do I evaluate paid vs free VAT calculators?

A: Consider free government tools first, then assess if advanced capabilities of paid tools are worth the cost for your business needs.

Q: Can I trust any online VAT calculator for compliance?

A: Verify accredited VAT calculators that precisely match HMRC guidelines. Avoid tools with no reputation or unclear methodology.

Q: How often are updates needed to VAT calculators?

A: Reputable calculators update in real-time as VAT rates/rules change. Be wary of outdated static calculators.

Q: Should I use VAT calculators provided by accounting software?

A: Sometimes ideal for integration, but standalone calculators allow more flexibility and customization in your choice of accounting software.

Q: What security measures should online VAT calculators have?

A: At minimum, SSL encryption and data privacy compliance. Avoid any dubious calculators with no visible security or credibility.