VAT Schemes in the Gig Economy: Rules and Criteria for Charging VAT on Freelance/Contractor Work

The gig economy comprising independent contractors and freelance workers has rapidly grown in recent years. However, VAT compliance for gig work can be complex with various schemes available. This guide examines the key UK VAT rules and criteria for freelancers to charge VAT correctly on their services.

Table of Contents

Determining VAT Registration Needs

The first step is determining if your freelance business needs to register for VAT in the UK. The main criteria are:

- You provide taxable services or goods in the UK exceeding the VAT registration threshold of £85,000 in 12 months.

- You are based in the UK and bill overseas clients more than £85,000 in 12 months.

- You buy services from EU members states over £85,000 in 12 months.

- Your services are exempt from VAT registration but you want to voluntarily register.

Even if below the threshold, registration may be beneficial for reclaiming input VAT. HMRC’s VAT registration eligibility tool can help you establish if mandatory or voluntary registration applies.

Choosing the Right VAT Scheme

Once registered, picking the optimal VAT scheme for your freelance or gig work is essential for compliance. The common options are:

- Standard VAT Accounting

This involves:

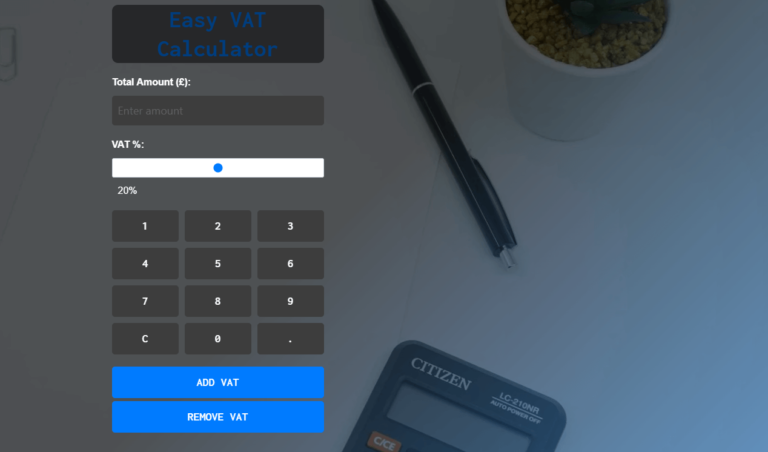

- Charging 20% VAT on your freelance services or products

- Submitting quarterly VAT returns and payments to HMRC

- Reclaiming input VAT paid on business expenses

It provides maximum flexibility but also quarterly reporting obligations. It is better suited for established freelancers with steady revenues.

- Flat Rate Scheme

This allows charging VAT and reclaiming input VAT but simplifies reporting, as you:

- Don’t report VAT you charge each quarter

- Pay HMRC your industry’s flat VAT rate on total quarterly earnings. Rates vary from 4% to 14.5%.

- Don’t need to track invoice-level VAT collected.

It reduces form-filling but gives lower VAT deduction benefits. It suits freelancers with mostly business-to-consumer services.

- Cash Accounting Scheme

Here you:

- Only account for VAT on invoices paid by customers, not just issued.

- Pay output VAT to HMRC after receiving payment from clients.

- Reclaim input VAT on expenses once you’ve paid suppliers.

This assists with cash flow by linking VAT timing to payments received/made. It is useful for freelancers with long client payment terms.

- Annual Accounting Scheme

This allows:

- Submitting just one VAT return annually rather than quarterly.

- Making a single yearly VAT payment to HMRC.

- Reclaiming input VAT quarterly still.

It reduces admin workload through less frequent reporting but requires disciplined yearly accounting. It is best for stable earnings.

Assess your business model, client base and administrative bandwidth to pick the optimal scheme. You can change schemes with proper notification to HMRC.

Understanding VAT Rules for Key Freelancer Expenses

Some common freelancer expenses also have specific VAT reclaim rules:

- Mileage claims: VAT can be reclaimed on fuel and maintenance costs. Keep detailed logbooks of business mileage.

- Home office costs: Claim VAT on household bills used for your freelancing if you work from home. Apportion bills accordingly between personal and business use.

- Subcontractor fees: VAT paid to other contractors for services can be reclaimed per standard VAT invoices issued to you.

- Most tools, software, equipment: Input VAT can be reclaimed on legitimate business-related purchases.

- Hotel, food, transport for client meetings: VAT reclaim possible with proper receipts and where no personal benefit is derived.

Ensure you understand HMRC’s policies around freelancer expenses to maximize eligible input VAT deductions. Maintain itemized records of bills paid.

Issuing VAT Invoices

To charge VAT as a freelancer, you must issue valid VAT invoices to clients with these mandatory details:

- Your VAT number and supplier details

- A sequential invoice number / unique reference

- Invoice date

- Client’s name and address

- Description of services provided

- Net amount charged excluding VAT

- Applicable VAT rate (usually 20%)

- Total invoice amount payable including VAT

Digital or e-invoicing is acceptable if digitally authenticated. Keep invoices organized for easy reporting and audit.

Settling VAT Liabilities

Your VAT payment process will vary based on the scheme chosen:

- Standard accounting: Pay VAT quarterly based on your VAT return.

- Flat rate: Pay your flat industry VAT percentage on turnover quarterly.

- Cash accounting: Pay VAT once you’ve received payment from clients.

- Annual: Pay one yearly VAT amount based on your annual return.

You can submit payments electronically via bank transfer or cheque. The deadlines are 1 month and 7 days after the end of your reporting period.

Managing VAT Compliance

To remain VAT compliant, freelancers must:

- File all VAT returns accurately and on time per your scheme. Late fees apply for delayed filing.

- Pay VAT liabilities by deadlines to avoid interest charges. Tax advisors can assist with planning.

- Keep transaction records for 6 years in case of audits. Digitize documents for accessibility.

- Inform HMRC promptly about any changes in your operations that could impact VAT obligations.

- Stay up to date on VAT rule changes and seek clarification from HMRC or advisors when unsure.

- Consider using accounting software to simplify VAT calculation, reporting and payments.

With some forethought into choosing the optimal VAT scheme and diligent compliance, freelancers can meet their VAT obligations while maximizing reclaims on expenses.

Common VAT Issues Faced by Freelancers

Freelancers often face some key pain points and queries around VAT compliance:

When do I charge VAT to clients?

Only collect VAT once you are registered with HMRC. Otherwise, it constitutes tax evasion.

Can I still claim VAT expenses if not registered?

No, you can only reclaim input VAT on business expenses after registering for VAT with HMRC.

What do I do if a client won’t pay VAT?

Politely explain the legal requirement to charge VAT once registered. If they refuse, consider not taking the engagement.

When can I de-register from VAT?

You can apply for VAT de-registration if your taxable sales fall below the threshold for 12 consecutive months.

Can I switch between VAT schemes?

Yes, you can change schemes with proper notice to HMRC. Be aware of impacts on payments and reporting.

By picking the optimal VAT scheme, issuing proper invoices and adopting good compliance practices, freelancers can effectively navigate VAT rules and requirements. Always reach out to qualified advisors for guidance on current VAT regulations impacting your freelance business. With some prudence around VAT accounting, gig workers can comply with regulations and avoid penalties.